ev tax credit 2022 cap

This incentive is not a check you receive in the mail following a vehicle purchase but rather a tax credit worth 7500 that you become eligible for. This credit applies to.

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Federal EV tax credits of 2500-7500 are available for new EVs and plug-in hybrids but not for hybrids.

. An EV with at least a 5 kWh battery capacity can snag you another 417 plus another 417 for each kWh above that 5 kWh threshold. The US Senate has voted to approve a non-binding resolution setting a 40000 threshold on the price of electric cars that would be eligible for a 7500 federal tax credit. General Motors became the second manufacturer to hit this milestone in the final financial quarter of 2018.

Each automaker has a cap of 200000 sales as far as tax credits are concerned. From 2020 you wont be able to claim tax credits on a Tesla. In 2022 taxpayers may be eligible for a federal tax credit of up to 7500 for electric vehicles.

The provision requires that a new qualified plug-in electric drive motor vehicle. Well talk about what a point is how it operates and more in this blog. Form 8936 is an IRS form for claiming the Qualified Plug-in Electric Drive Motor Vehicle Credit on an individuals tax return.

4000 Base Tax Credit. Many EVs these days have a 100 kWh battery which would easily max out that 7500 credit. House Bill 1159 enacted.

What Is the New Federal EV Tax Credit for 2022. If your new EV qualifies. Senate passes measure for 40000 cap on the EV tax credit and only EVs priced under 40000 would be eligible for 7500 credit under this plan.

That combined with the federal EV credit of 7500 will bring costs down 10000 per vehicle she said. 82 rows 2022 Electric Vehicle Tax Credits. To date there has not been either a cap on MSRP of the EV nor incomeAGI of the taxpayer.

Get a federal tax credit of up to 7500 for purchasing an all. The current tax credit has a base of 2500 and is replaced with a new 4000 base credit as long as the EV has a battery of at least 10 kWh and can be plugged in and recharged. We are financial advisors in La Jolla CA.

Even an EV with a much smaller battery capacity say 16 kWh would max out the tax credit. California is lowering its MSRP limit and income cap for EV subsidies which offers 2000 USD for EVs and 1500 for plugin hybrids according to Green Car Reports. As Toyota reaches its market cap of 200000 Prius Primes and RAV4 Primes being sold the 2022 EV Tax credit will soon be phased out.

The state has lowered its max MSRP limit for eligible EVs to 45000 from 60000 for passenger cars. The credit applies to the year you buy the vehicle and your tax credit is capped at how. Which EVs Hybrids Qualify.

As mentioned below however the 10 kWh. Californias MSRP limit on trucks and SUVs will remain at 60000. January 25 2022.

Heres how you would qualify for the maximum credit. The newest iteration of President Joe Bidens Build Back Better bill proposes tax credits of up to 12500 for some electric vehicles if. The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles.

The eligibility of something like the federal subsidy scheme varies by the carmaker and is determined by the total operation of electric vehicles sold. Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. Increasing the base credit amount to 4000 from 2500 is fine.

Then from October 2019 to March 2020 the credit drops to 1875. Updated 5272022 Latest changes are in bold Other tax credits available for electric vehicle owners. Taxpayers may receive up to 7500 as a federal tax credit for electric cars in 2022.

In this blog we will discuss what the credit is how it works and more. The new credits if Biden and Democrats finalize a deal would jump to 12500 maximum. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

To qualify automakers must build the EV in the US with union labor for an extra 4500 over the current. Current EV tax credits top out at 7500. So now you should know if your vehicle does in fact qualify for a federal tax credit and.

President Bidens EV tax credit builds on top of the existing federal EV incentive. C40 Recharge Pure Electric. XC40 Recharge Pure Electric P8 AWD.

While this question is often hotly debated on social media the proposed changes to IRC 30D would draw a line in the sand and establish an 80000 MSRP cap on the credit. From April 2019 qualifying vehicles are only worth 3750 in tax credits. Up to 7500 Back for Driving an EV.

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

.jpg)

Latest On Tesla Ev Tax Credit March 2022

Joe Manchin Says Ludicrous Electric Vehicle Tax Credit Not Needed Bloomberg

How To Calculate The Federal Tax Credit For Electric Cars Greencars

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

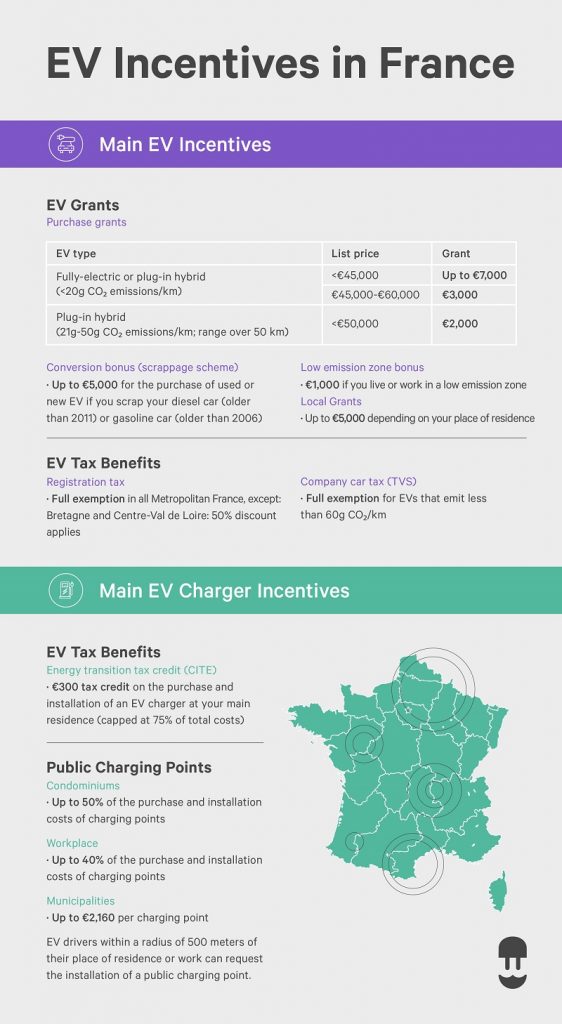

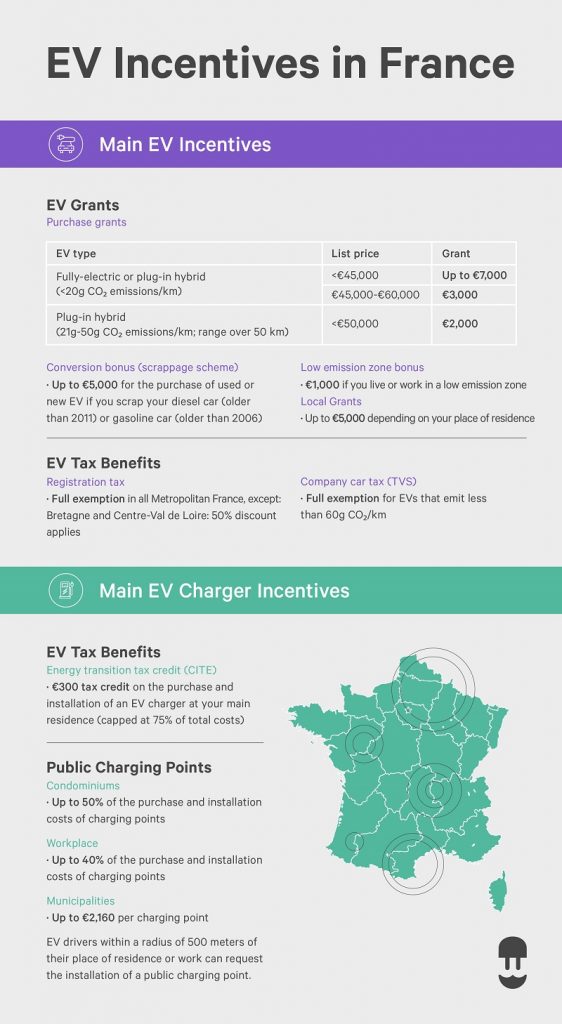

Ev Incentives In France Complete Guide Wallbox

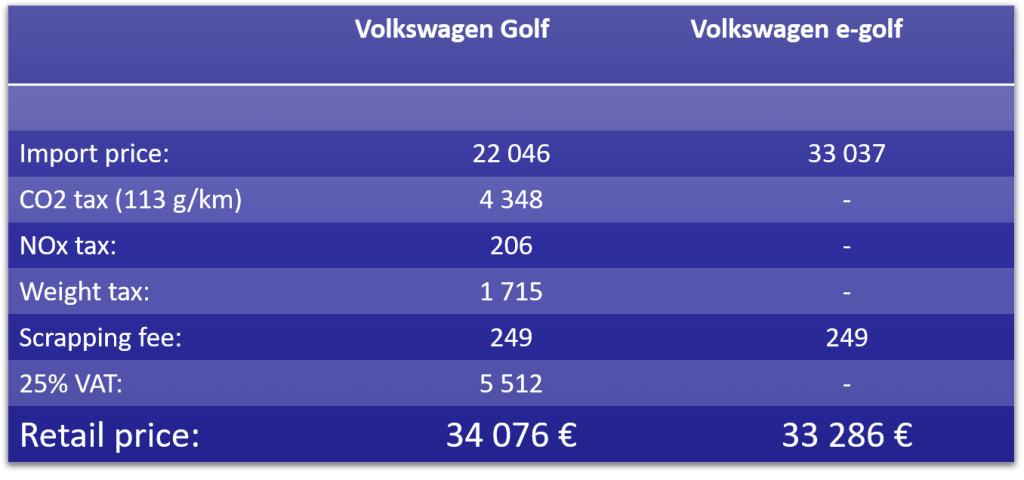

Norwegian Ev Policy Norsk Elbilforening

Latest On Tesla Ev Tax Credit March 2022

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Income Eligibility Clean Vehicle Rebate Project

Toyota S Ev Tax Credit Cap Is Expected To Be Reached Soon Bloomberg

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ONRZXM3RRFOXTLGPQOAIG4AO3Q.jpg)

Key Senator Questions Need For Expanding U S Ev Tax Credit Reuters

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Everything You Need To Know About Ev Incentives In The Netherlands Evolve